Outside Bar Failure

Jan 26, 2021

Outside Bar Failure - a Trading Setup

When the market opens up and then fades down below the low of previous day — Bears are good and feel accomplished. During the last couple of hours, it reverses course and ends up closing above the last trading session. This makes bulls cheer up, and leaves bears holding the bag. Below are the two scenarios that we can expect to see in such a market behavior.

This kind of price action shows confusion and indecision. Emotions drive behavior and both bulls & bears are trying to capture the next big move. Bulls want to buy above the outside bar and bears want to short below it.

What do we want?

Well, we as smart traders, we want to take advantage of their situation and profit from it.

Long Setup

- 5 sma is trending up or looks to be in a decent uptrend

- The stock breaks below the low of the bearish outside candlestick

- Put a buy-stop order above any bullish bar within the next 2 to 3 bars

As you read the charts below, try to understand the psychology behind these setups as well. Basically we are trapping counter-trend traders.

In the example below, we are trying to trap the folks who think they are shorting at the top. It is a 15 minute chart of $QQQ. I have mentioned the trade set up on the chart with detailed comments.

We got a bearish outside bar around 12:45pm. There was no follow through on the downside after this move. 5 SMA was trending up. The next bar was a bullish hammer. Place a buy-stop order couple of ticks above this bullish bar. The stock went sideways for the next 10 minutes (2 bars) before filing our order on the third bar.

You can apply this on any time frame as long as the rules of engagement are fulfilled.

Here is $SPY daily chart (last trading session of the week as markets were closed on Friday).

5 SMA is up + we got a bearish outside bar the day before + almost Bullish Hammer bar on Thursday.

You can put a buy-stop order above the high of hammer bar, and wait for it to execute within the next couple of bars.

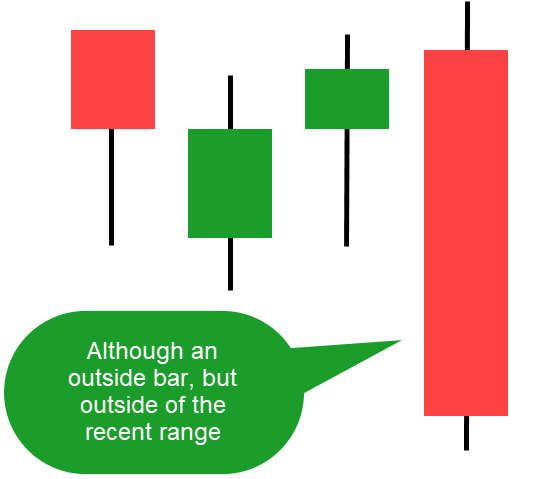

If you want to add some confidence to your trades, then go for outside bars that are also classified as ‘Trend bars’, meaning Candlesticks with big bodies and short wicks. And also the overall range of this outside bar is small within the context of recent trend. What this means is that it cannot be a long trend bar that overshadows the recent price action.

You should be able to trade such setups in any kind of market. Trending and sideways action, both should provide ample opportunities. For Short setups, do the following.

Short Setup

- 5 sma is trending down or looks to be in a decent downtrend

- The stock breaks above the high of the bullish outside candlestick

- Put a sell-stop order below any bearish bar within the next 2 to 3 bars

Any questions, please do not hesitate to reach out.

If you like Price Action based trading, and like to learn more about it to be able to spot trades on your own - please check the Price Action Trading course.

Get weekly Trade Ideas and Performance updates

Join our weekend newsletter list to receive the performance updates and trading setups.

We hate SPAM. We will never sell your information, for any reason.